Jio Financial wants to lend routers so that Reliance Retail's revenue goes up

It's all one big family, after all

We’ve spoken about this a couple of times. If you’re a billionaire, you probably like having separate companies for separate businesses. One of your businesses might be old, boring and predictable. It’s probably what brings in a stable income every month. Another of your businesses might be batshit crazy with years to go before it sees a profit. If the wacko blows up, you don’t want the reliable uncle to go down with it.

This insulation is nice for you, and it’s nice for your investors who can pick and choose the companies they like and ditch the ones they don’t. In general, having multiple companies doing different stuff is a good thing.

Sometimes, though, these companies might intersect. If one of your companies is, say, a large retail company, and the other is a payments company, it might make sense to plug your payments company into your retail company wherever you can. That way, your payments company can get some business, and your retail company can hopefully get a discounted price.1

Let’s change the example. Let’s say business hasn’t been great for your retail company. Now, what if you created a new company just so that it could go and buy stuff from your retail company? That’s probably not too nice. From the Ken last week:

Reliance Industries (RIL) is back with yet another one-of-its-kind deal structuring—this time, targeting three birds with one stone.

The latest instance of the deal-structuring chops of the Mukesh Ambani-controlled oil-to-retail behemoth lies in a proposal from its youngest child, Jio Financial Services. The financial services entity wants to buy and lease customer premises equipment/devices and telecom gears, such as airfibre, phones, and laptops, worth Rs 36,000 crore (US$4.3 billion) over the two years ending March 2026.

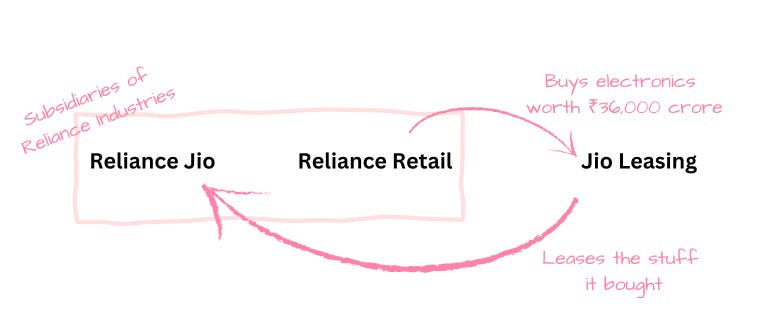

There seems nothing exceptional about it, except that Jio Financial wants to do this big deal in-house. Its subsidiary, Jio Leasing Services, plans to buy the equipment from group company Reliance Retail and lease it to customers of Reliance Jio Infocomm, RIL’s telecommunications arm.

Mukesh Ambani owns both Reliance Industries and Jio Financial Services.2 Jio Financial Services—which doesn’t even have a financial services business yet—has a subsidiary called Jio Leasing Services. This subsidiary, Jio Leasing, is going to buy some electronics from Reliance Retail, a subsidiary of Reliance Industries. Jio Leasing will then lease these electronics, which I guess would be stuff like routers, modems, antennas, to customers of Reliance Jio, the telecom company which like Reliance Retail is a subsidiary of Reliance Industries.

Also—Jio Leasing is going to buy ₹36,000 crore ($4.4 billion) worth of stuff?! Jio Financial, which owns Jio Leasing, is an NBFC whose primary business is supposedly to lend out money, charge an interest, get repaid. It’s not begun doing that yet, but it is spending $4.4 billion over two years to lend out some routers and modems instead?3

You know what? Fine. Maybe routers are going to replace fiat money very soon. And all lending and borrowing is going to be denominated in TP-Link routers. Maybe the RBI is going to ask banks to ditch their Rupee reserves and switch to routers instead.

Even so, why does Jio Financial buy those routers from Reliance Retail? Here’s the company’s rationale from its postal ballot notice asking shareholders to approve this transaction (among others):4

RRL [Reliance Retail] is in the business of dealing in customer premises equipment, enterprise devices and other telecom devices. RRL is able to procure these goods at competitive prices due to large volumes and RRL will be providing these devices to JLSL [Jio Leasing] at cost plus agreed margin.

Umm.. Jio Financial is buying $4.4 billion worth of stuff. Sure, Reliance Retail might be able to procure these goods at competitive prices. But couldn’t Jio Financial? If I was spending $4.4 billion, I wouldn’t go to a retailer. I’d go to the manufacturers and pick the one that danced the best.

Cover Photo by Anna Shvets/Pexels

This is happening! In addition to Jio Leasing Services buying from Reliance Retail, another subsidiary of Jio Financial—Jio Payment Solutions—is going to manage payments for Reliance Retail’s stores as well as website. In addition to, of course, buying equipment from Reliance Retail itself. It seems to me like buying from Reliance Retail is every Jio Financial subsidiary’s rite of passage.

I mean, they’re both listed companies so Ambani doesn’t technically “own” them. He just owns huge chunks of both.

At the end of March 2024, Jio Financial had ₹24,000 crore in total assets. How is it going to pay ₹36,000 crore to Reliance Retail? Unfortunately, they don’t tell us that. Hopefully it’s something funny so that I can write about it.

Since the possible conflict of interest in transactions like this is obvious, Jio Financial has to take shareholder approval for them to go through. Considering Ambani owns nearly 50% of Jio Financial, it probably will go through.

Seems like a way to pad the books for transactions. Based on my level 1 knowledge of balance sheets,

Reliance retail selling stuff will create trade receivables, cash conversion cycle ratio, asset turnover ratio, sales, profit, free cash flow

Jio leasing buying it will increase assets and inventory, reduce tax liability, offset profits by claiming depreciation

Leasing inventory out to jio will increase revenues, profits, build a business history, keep 100% of assets and have next to 0% operational costs and still get revenue, increase ROA, ROCE, and finally jio financial won’t just be a hype company but an actual business o n the books.

Reliance Jio ( the buyer) leasing equipment will reduce legal liability, create business expenses so shareholder profit mightbe reduced on reliance industries side so promoters can pocket more via other subsidiaries, tax liability is further reduced in expenses.

Also, this means the other companies will have good standalone balance sheets, instead of just good consolidated ones, setting them up as individual entities that can borrow money, leverage their non existing assets to increase influence, outreach and capital

Or I’m a complete moron and all this is garbage. Billionaires don’t do infinite money glitches. /s

If they want to lend me a router, I am fine with it. As long as they lend me the router that I want and I get to keep it after I've paid it off.